As an AtlasMark client, you work with a firm fully committed to helping achieve your financial goals. We devote substantial resources to serve our clients financial objectives each and every day. Becoming part of our private wealth management group relieves the stress that comes with managing large sums of wealth.

Our team first takes a comprehensive look at your financial picture – both resources and needs. We then work with you to systematically develop a central strategy to help achieve all your financial objectives.

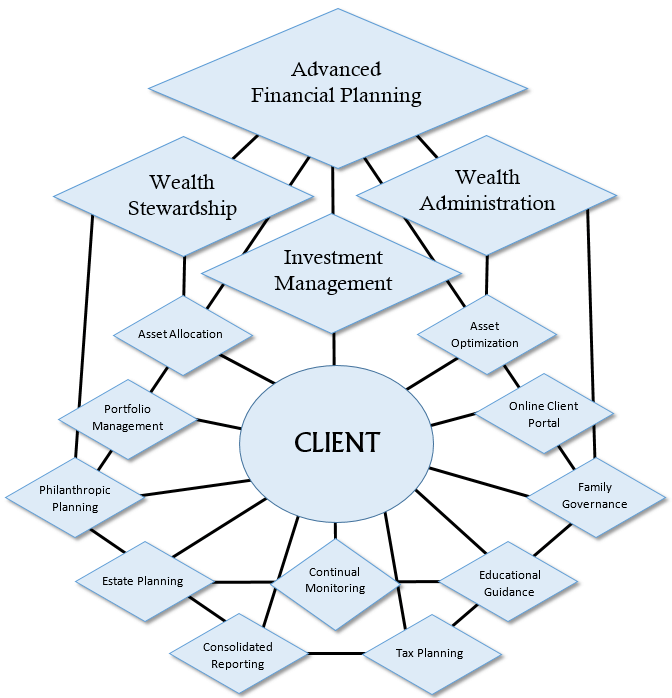

There are four financial pillars to our private wealth management group:

- Advanced financial planning

- Investment management

- Wealth stewardship, and

- Wealth administration

Each pillar serves a critical role in growing and protecting your wealth.

We believe in keeping clients fully informed, engaged, and educated throughout the entire process. By doing so, we work efficiently as a team to enhance your financial well-being.

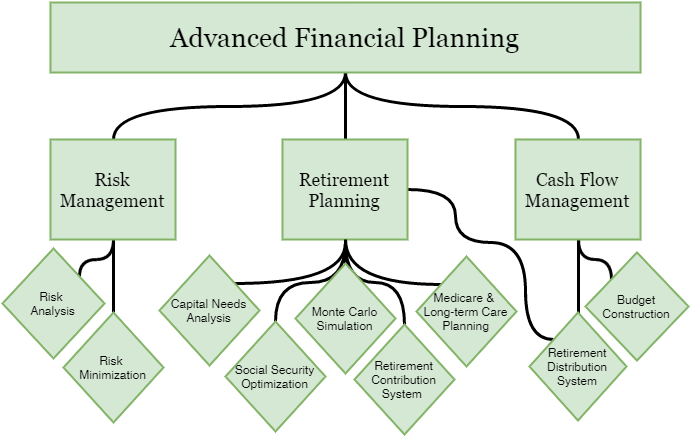

Advanced Financial Planning

Risk Management | Retirement Planning | Cash Flow Management

Introduction

Clients who become a part of our private wealth management group have access to advanced financial planning services seldom offered by other financial planning institutions. This gives our clients a better picture of where they are, where they want to be and more importantly how to get there.

The advanced financial planning process begins with a wide range of financial surveys and direct communication to help our team understand your current financial situation and your ultimate goals.

This information will be used to create a centralized plan to help achieve long term success. The goal of this process is to grow your financial base by using projections and assumptions, rather than emotion.

Our approach focuses on three core elements of financial planning – Risk Management, Retirement Planning, and Cash Flow Management.

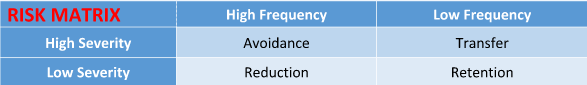

Risk Management

Risk Analysis

Managing risk is an integral part of the financial planning process, yet it is often neglected. Sometimes it helps to view the risk analysis as backing out of your drive way. Only when you safely reverse can you begin to move forward to your destination. To many, that destination is portfolio management and investments but it is essential to the financial planning process that we first back out of the driveway by conducting a risk analysis.

During your risk analysis, our firm will objectively review potential factors and what kind of risk minimization strategy you are using. This will allow us to determine any risks that are not being covered and begin to formulate a plan of action to minimize those risks.

Risk Minimization

Risk minimization becomes increasingly important as you continue to grow your net worth. As clients reflect back on the length of time it took to accumulate their wealth, they begin to realize just how important it becomes to protect that wealth. Without adequate protection, one fatal accident can quickly decimate an individual’s wealth.

Depending on the type of risk identified during our analysis, we will use a variety of methods to properly reduce that risk.

Our View on Insurance

AtlasMark is not an insurance agency nor is it our job to sell you insurance. Instead, we develop the most cost efficient method of reducing your identified risk. Insurance may not even be involved. ERISA protection and bankruptcy laws are often employed to prohibit creditor seizing an individual’s assets.

AtlasMark is not an insurance agency nor is it our job to sell you insurance. Instead, we develop the most cost efficient method of reducing your identified risk. Insurance may not even be involved. ERISA protection and bankruptcy laws are often employed to prohibit creditor seizing an individual’s assets.

If insurance is needed, we will work closely with you to determine the most effective protection to ensure your beneficiaries are taken care of if you’re not around.

Insurance is a necessary evil – our recommendation to transfer risk may include the purchase of insurance. We will assist you to develop and find the most cost efficient method to fulfill your need.

Retirement Planning

Capital Needs Analysis

The capital needs analysis is the process of calculating the amount of investment capital you will need at retirement. Typically, individuals in retirement will need to supplement between 80-85% of their current salary to maintain the same standard of living they are accustomed to living.

In addition to discounting future streams of income in retirement, capital needs analysis must also involve forecasting market returns and other assumptions to help guide clients to determine their financial need.

AtlasMark sophisticated software takes care of the science but the expertise of the firm ultimately gives you a better financial picture based upon years of experience rather than a simple, cut and paste capital needs analysis that many financial planning firms employ today.

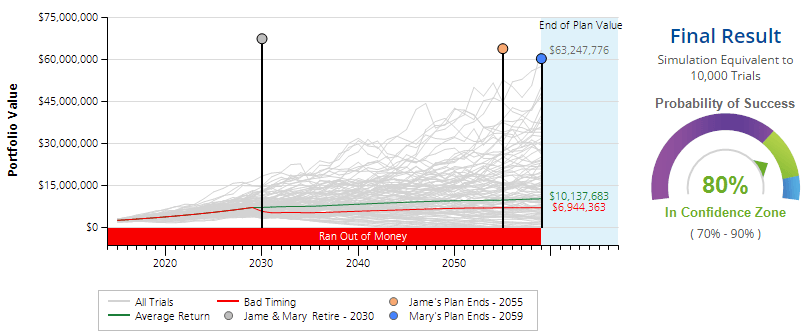

Monte Carlo Simulation

Monte Carlo Example

The Monte Carlo simulation is an advanced financial planning technique used to determine the probability of retirement success based upon a set of assumptions. The process helps our clients to better understand and visualize realistic outcomes given thousands of potential future market returns.

Asset Accumulation

After the capital needs analysis determines how much you will need in retirement, it is essential we create an asset accumulation plan to help to ensure the long term success of your overall financial plan. We accomplish this through a system of automatic contributions which are invested with little to no involvement on your part. We will help you set up the automatic investment plan and create an asset accumulation plan customized to your particular account type.

Social Security Optimization

Social security can be a powerful income stream for many Americans in retirement. For most, it becomes a significant primary income stream that is provided for by the Federal Government. Full Social Security benefits begin at 67 for those born after 1959, however individuals may delay applying for those benefits until age 70 in order to receive an 8% increase in their benefits each year.

Social security can be a powerful income stream for many Americans in retirement. For most, it becomes a significant primary income stream that is provided for by the Federal Government. Full Social Security benefits begin at 67 for those born after 1959, however individuals may delay applying for those benefits until age 70 in order to receive an 8% increase in their benefits each year.

AtlasMark will help to advise clients on the most appropriate time for them to begin to take their social security benefits. We will run a social security optimization that helps us to determine the most efficient time based upon their individual goals and objectives.

Medicare & Long-term Care Planning

Long-term care planning is becoming increasingly more important each year as the cost of medical care and drug prices continue to skyrocket. AtlasMark will assist you to plan for these costs in order to help to ensure you have adequate resources to provide for the cost of care in your retirement years.

Long-term care planning is becoming increasingly more important each year as the cost of medical care and drug prices continue to skyrocket. AtlasMark will assist you to plan for these costs in order to help to ensure you have adequate resources to provide for the cost of care in your retirement years.

Insurance can be confusing and intimidating. We will help clients to understand their Medicare health benefits and to determine whether additional coverage (Medicare Supplement Insurance or Medigap) is required.

Cash Flow Management

Budget Controls

Creating and maintaining a budget is important to the long-term success of your financial plan. Using Wealth Summary, our online client portal, we help you and your family to construct an online budget based upon your goals, savings, liabilities and expenses. The portal allows you to automatically download your banking and credit or debit card information to track real-time spending data. It is a wonderful feature many of our clients have come to love.

Retirement Distributions – The Bucket System

Retirement distributions can become complex, especially when clients maintain multiple registrations and retirement accounts. To make matters worse, the Internal Revenue Service requires individuals to begin taking required minimum distributions (“RMDs”) once they reach age 70 1/2. Once RMDs commence, failure to timely and properly withdraw the minimum amount can result in a penalty of 50% of the required amount failed to be withdrawn. AtlasMark will help to make sure all of our clients take their RMDs timely, as well as determining which investments to sell in the account to satisfy the RMD.

In order for our clients to fully visualize the withdrawal process, we use the Bucket System to illustrate the retirement distribution sequence. The Bucket System allows us to minimize the risk of selling an investment at an inappropriate time resulting in a loss of account value due to poor market performance.

In order for our clients to fully visualize the withdrawal process, we use the Bucket System to illustrate the retirement distribution sequence. The Bucket System allows us to minimize the risk of selling an investment at an inappropriate time resulting in a loss of account value due to poor market performance.

Inside your Spending Bucket is typically 1 to 2 years’ worth of expenditures, which will be directly deposited into your bank account similar to a paycheck. This reserve provides our clients the peace of mind they will have sufficient cash flow despite the ups and downs of the market. As we review and rebalance your portfolio, we will also look inside your Spending Bucket to determine whether or not the assets should be replenished.

The Bucket System becomes an important tool when market volatility increases dramatically. Clients are comforted knowing they have sufficient liquidity, which in turn allows time for market volatility to subside and the overall market value to recover. A primary goal is to avoid selling equity securities during a depressed market and to further benefit from a market rebound.

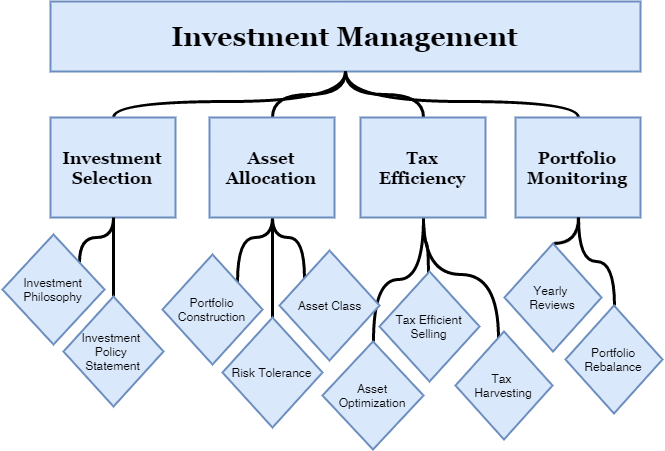

Investment Management

Investment Selection | Asset Allocation | Tax Efficiency | Portfolio Monitoring

Introduction

Investment Management is critical and represents a major pillar in the financial planning process. Our clients must be actively engaged and involved in order for us to help the client achieve the long-term success of the plan.

As part of our Private Wealth Management Group, our clients will have access to all essential Investment Management components. Our Investment Management service is built with a long term view and is comprised of investment selection, asset allocation, tax efficiency and ongoing portfolio monitoring.

Investment Selection

Investment Philosophy

Investment portfolios are typically comprised of mutual funds, stocks, bonds, exchange traded funds (ETFs), etc. We believe that with a long term time horizon, clients are able to benefit from the capital appreciation of market securities along with the foundation built from less aggressive investment options. It is important for us understand a client’s risk tolerance in order for us to create a realistic expectation for the portfolio over a long period of time. Risk and reward are two common themes, however no client has an infinite risk tolerance. Therefore, we help to design a portfolio which will help to keep risk and reward in a delicate balance within the allocation. There are many different paths to achieve your financial goals. We aim to help achieve those goals with the least amount of risk possible.

Our investment philosophy helps to ensure you are able to withstand the emotional turbulence that can come with market volatility. Our investment analyst team accomplishes this goal by evaluating your current portfolio, risk tolerance, time horizon, tax status and always involves ongoing client communication and education. We believe the most effective investment portfolio will help you to achieve your retirement goals in a realistic timeframe.

Investment Policy Statement

An Investment Policy Statement (IPS) outlining the general investment rules and guidelines for your portfolio. The IPS details the investment goals and objectives for each client including, the asset allocation, risk tolerance, rebalancing methodology and other important processes and procedures for each client’s customized investment strategy. The IPS is an important document serving as an emotional guidepost for our clients when weathering market fluctuations. It acts as a beacon or roadmap helping to minimize irrational decision making during turbulent periods.

Asset Allocation

Risk Tolerance

Risk tolerance represents the subjective ability for clients to withstand the market fluctuations which may cause periods of losses within their portfolios. On October 19th, 1987 (the day known as “Black Monday”) the Dow Jones Industrial Average lost 22.6% in a single trading day. A client’s willingness to accept losses of this magnitude act as a gauge to determine the most appropriate allocation to meet the client’s expectations.

We must also keep in mind each investment carries an inherent Risk Capacity. Simply put, risk capacity is a measure of the amount of risk an investment supports – independent of a client’s willingness or expectation.

We use a client’s risk tolerance to help design a portfolio to meet the customized goal or objective. It must also be conveyed to clients that their goals must align with their relative risk tolerance in order to best achieve their realistic objectives. Commonly, a client’s risk tolerance will change either through perpetual education or simply the passage of time. It is important to keep our clients actively engaged through the entire process to make sure expectations are contained.

Asset Allocation

At AtlasMark, we believe more than any other factor that an appropriate asset allocation contributes the majority towards the successful outcome of a client’s investment strategy. Asset allocation represents the distribution between various asset classes in order to achieve a stated investment goal. Determining the appropriate asset allocation becomes the foundation for creating the primary investment plan, however this foundation must be continually evaluated and modified throughout the entire investment timeframe. Although an asset allocation may serve the needs of a client’s portfolio currently, it must be re-evaluated in the future to make sure the allocation continues to be suitable. As a client’s needs change, so too must the asset allocation.

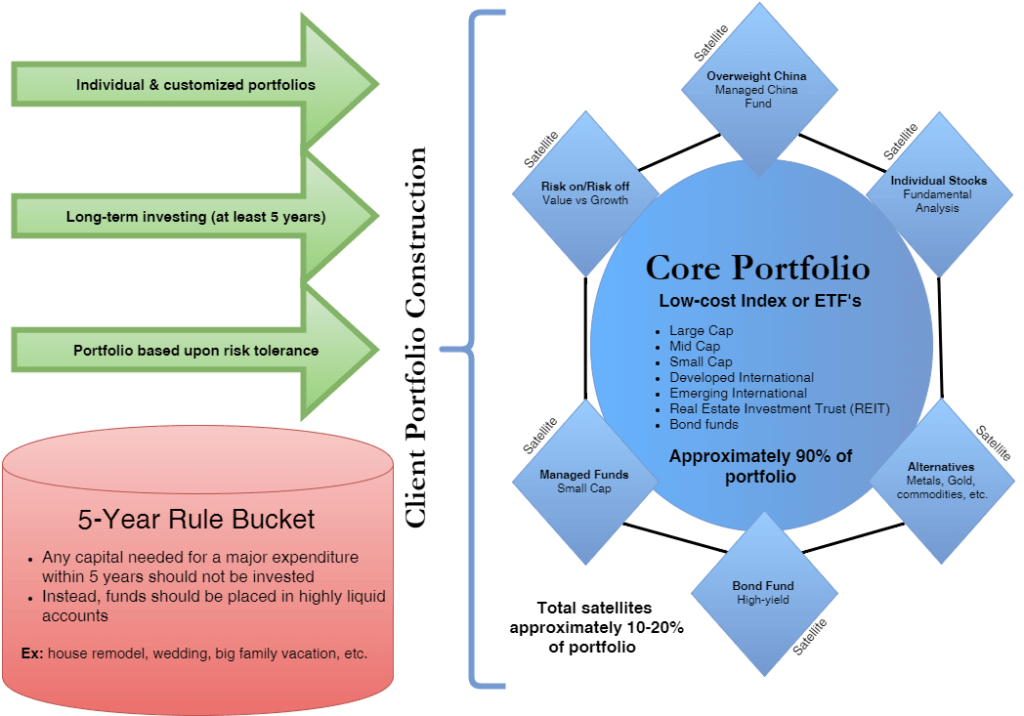

Portfolio Construction

Once an asset allocation is established, the next step is to determine the most appropriate method with which to construct the client’s portfolio. Firm investment philosophies vary wildly, and arguably represent one of the more defining characteristics of investment managers.

At AtlasMark, we believe it is and has become increasingly difficult for actively managed investment options to outperform their passively indexed counterparts. Our methodology is focused less on beating the market and more so on tactically allocating a client’s portfolio to benefit from prevailing market conditions.

AtlasMark has developed a portfolio design methodology which we refer to as our Satellite Strategy. We define a Core Portfolio, which is broadly diversified across multiple sectors, industries, market and countries.

We then incorporate a Satellite Portfolio, which revolves around the Core Portfolio allowing for greater concentrations into various investment areas. We believe this strategy allows for the greatest flexibility as conditions call for alternative investment approaches.

Asset Class

Beyond the broad asset categories of stocks, bonds and cash – several asset classes exist within each category to more narrowly define the underlying assets’ characteristics. Each asset class carries its own risk and return profile which helps investors to determine the suitability of each investment depending on the client’s need. A component of AtlasMark’s investment management service is to help ensure our clients have an appropriate mix of each asset class utilized.

Tax Efficiency

Asset Optimization

Asset optimization is the process whereby we determine which investments are most appropriate for each account registration depending upon the client’s tax situation. Account registration types have their own unique tax status characteristics, and we aim to use those differences to our advantage to gain the most out of the investment’s potential. For example, assets held inside Roth accounts (either Roth IRAs or Roth 401(k)s) typically grow on a tax-free basis as opposed to a tax-deferred basis assuming the rules governing Roth accounts are satisfied. A significant advantage may be achieved by investing in assets believed to carry the highest anticipated capital appreciation potential, since the growth on those investments will not be taxed. Using this thought process, you can quickly see a tremendous benefit to making sure different investments are held within the most advantageous account registration.

Tax Efficiency

The IRS taxes investment income differently depending on the income characteristics and holding period of the underlying investment. Several common types of investment income and the tax consequence of that income include:

- Tax Exempt Interest – This is interest earned on Municipal bonds. The Federal Government does not tax this type of income and is therefore tax-free.

- Taxable Interest – This is interest earned on bonds, CDs and other similar investments. This income is taxed as ordinary income.

- Ordinary Dividends – These represent distributions from a corporation or a mutual fund paid from the corporation’s earnings or profits. This type of dividend is taxed as ordinary income, and is most commonly seen in dividends paid by foreign corporations or those whose holding period requirements are not met.

- Qualified Dividends – This type of distribution is from a corporation or a mutual fund paid from the corporation’s earnings or profits, however these are taxed at capital gain rates rather than ordinary income rates.

- Capital Gains/Losses – Capital gains or losses occur when an investor or mutual fund manager sells an investment at a price above or below the initial price of the investment.

- Investments held for one year or less are considered short term and are taxed at ordinary income rates.

- Investments held for greater than one year are considered long term and are taxed at capital gains rates.

AtlasMark uses the different tax laws to develop a tax efficient portfolio for our clients. Our expertise allows for these significant benefits to be achieved simply by better understanding the consequences of each investment type and the related tax liabilities generated.

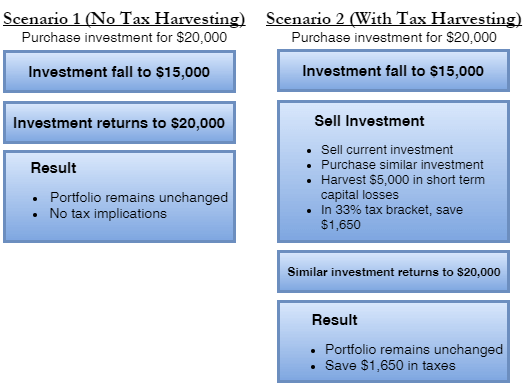

Tax Loss Harvesting

Tax loss harvesting is a tax strategy whereby investors can systematically lower their current and future income tax liability. It is the practice of selling an investment at a loss and using the proceeds to purchase a similar investment.

When properly executed, the transaction avoids the IRS wash sale rules and also maintains your original overall asset allocation. By realizing or “harvesting” the loss from the sale, you are able to offset current taxes – potentially both on income and capital gains.

When properly executed, the transaction avoids the IRS wash sale rules and also maintains your original overall asset allocation. By realizing or “harvesting” the loss from the sale, you are able to offset current taxes – potentially both on income and capital gains.

The most effective use of this strategy involves scenarios where short-term losses are used to offset current income taxed at ordinary income rates. However, the strategy also works with long-term investments where losses offset others sold at a gain or are carried forward to offset future capital gains from other investments. The corresponding example illustrates how a short-term tax harvesting strategy might work.

It is important to understand this is not intended to be a market-timing strategy. Investors are simply able to use the tax law to their advantage by creating additional returns on their portfolio. We encourage an ongoing review of your portfolio to seek such opportunities.

Portfolio Monitoring

Annual Review

AtlasMark will review your portfolio on a periodic basis to determine the continued suitability of your current asset allocation. From time to time your portfolio may need to be rebalanced or reallocated based on changes in your financial circumstances. We encourage these reviews independent of changes in your personal situation. It allows us the opportunity to further evaluate and discuss your portfolio as well as to address any concerns you may have.

Portfolio Rebalance

Rebalancing is the systematic realignment of your investment percentages to the appropriate asset allocation as an asset class increases or decrease beyond a suitable tolerance range. Typically, it is recommended that a portfolio should be rebalanced when any asset class extends beyond a 10% range above or below the investor’s tolerance. As an added benefit, rebalancing provides for a disciplined and systematic method for not only buying low and selling high – a basic tenant of investing – but also curbing the emotional overriding of logical and prudent investment management.

In order to illustrate the concept, lets consider an example where an investor’s large cap value investment increases from an allocation of 23% to 33% of the overall portfolio and the international investment decreases from 11% to 1% during the same period. In this scenario, investors may resist selling their large cap value investment because it has generated high returns. However, a disciplined rebalancing strategy would allow for selling the investment at a high price and rebalancing the proceeds to purchase more of the international investment at a lower price. The process ultimately allows the investor to realign the portfolio to the original 23% large cap value and 11% international investment.

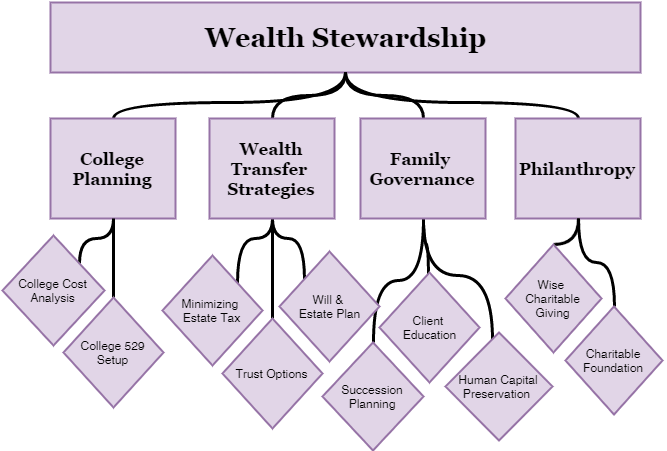

Wealth Stewardship

College Planning | Wealth Transfer Strategies | Family Governance | Philanthropy

Introduction

For families that have managed to accumulate real wealth, the attention inevitably shifts to now what to do with it. Clients must first philosophically determine how they believe their wealth ought to be distributed, if at all. The concept is difficult for most to envision, and the overall outcome is equally difficult to foresee. There are several foundational channels which exist to guide clients on their path to planning for their Wealth Stewardship.

For clients planning to provide for the well-being of their loved ones, a variety of options exist with which to facilitate those plans. These methods range from college planning to charitable giving.

Wealth Stewardship consists of many components – we will primarily focus on 1) College Planning, 2) Wealth Transfer Strategies, 3) Family Governance and 4) Philanthropy. Effective use of these strategies help to create and enhance client wealth and help to empower beneficiaries as they prepare to grow and become responsible for themselves.

College Planning

College Expense Analysis

According to the College Standards Board®, “the average 2014-2015 tuition increase was 3.7 percent at private colleges, and 2.9 percent at public universities.” Looking back over the last decade, the “10-year historical rate of increase is approximately 5 percent.” With such large annual increases, the importance of starting an educational fund as soon as possible is critical.

According to the College Standards Board®, “the average 2014-2015 tuition increase was 3.7 percent at private colleges, and 2.9 percent at public universities.” Looking back over the last decade, the “10-year historical rate of increase is approximately 5 percent.” With such large annual increases, the importance of starting an educational fund as soon as possible is critical.

AtlasMark will run a college expense analysis and determine the approximate amount you will need in your children’s educational fund to send them to college. Once we calculate the necessary amount to fund, we then discount that amount back to its present value to determine how much you will need to save each month, year or alternate timeframe.

529 Plan

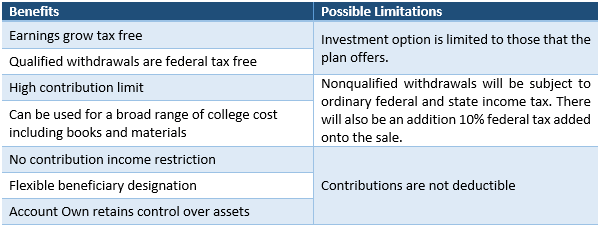

A 529 Plan is designed to help families from all income levels to save money for their children’s college expenses. These plans are governed by state, therefore each state will have their own 529 Plan option differing from state to state.

There are many advantages to using a 529 Plan when saving for college expenses, however there are a few drawbacks as well. For example, 529 Plan savings may affect your child’s eligibility to qualify for financial aid creating a slight drawback to this savings strategy.

There are many advantages to using a 529 Plan when saving for college expenses, however there are a few drawbacks as well. For example, 529 Plan savings may affect your child’s eligibility to qualify for financial aid creating a slight drawback to this savings strategy.

Nonetheless, most of the clients in our private wealth management group have large amounts of income and therefore would receive little to no financial aid either way. Consequently, a 529 Plan becomes an ideal investment vehicle to help them achieve their college savings goals.

Wealth Transfer Strategies

Will & Estate Plan

A Last Will and Testament helps to ensure your assets are passed down to your heirs according to your wishes. Most assets passing through a Will must pass through probate. AtlasMark will help to design more advanced techniques to help avoid the probate process when possible and always taking into account a client’s goals and objectives. In any case, we review your estate documents for implementation or possible improvement. It is important that each client has a (1) Living Will, (2) Power of Attorney for Healthcare, (3) Power of Attorney for Financial matters, and (4) an overall Estate Plan, including the use of trusts when needed.

Minimizing Estate Taxes

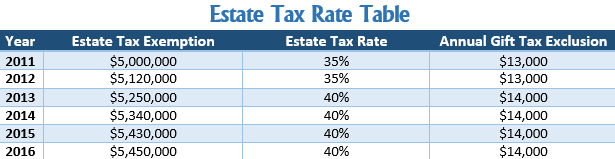

A potential Estate Tax is levied on the transfer of property at your passing. Your Estate typically consists of everything you own (or have an interest in) and is valued at fair market value at the date of death or at an alternative valuation date. The aggregate value of these assets is referred to as your “Gross Estate.” After certain deductions from your Gross Estate you arrive at your Taxable Estate.

Your Taxable Estate is then reduced by any remaining unified credit, commonly referred to as your Estate Exclusion. After deducing your Exclusion, the remaining assets are then taxed at the current Estate Tax rate. The corresponding table shows the current Estate Tax as of 2016.

An estate tax issue will arise if your taxable estate is above the estate tax exclusion limit which would equal $10,900,000 (both of your unified credits) at the death of the surviving spouse in 2015.

Trust Options

Trusts can serve many purposes – most commonly to help clients protect and transfer their wealth to others. By effectively using trusts, clients are able to:

- Provide for the long-term preservation of capital,

- Protect accumulated assets from creditors, divorcing spouses, etc.

- Potentially avoid Estate Tax liabilities, and

- Other Estate-specific goals.

We recommend consulting with our office to determine the suitability of trusts in your overall Estate Plan. Keep in mind no two client situations are identical, so be sure to provide as much information as you may deem relevant.

Family Governance

Client Education

Whether transferring large sums of wealth or simply preparing family members for the responsibilities that lie ahead, we are there to help align the common interests of the family unit. Anyone in the throws of grief by the loss of a family member or the turmoil of divorce understands the velocity at which financial information is thrust upon them and the value of having an advocate in their corner is priceless. We become a family liaison to help communicate and educate the family through any financial matter.

Succession Planning

Affluent families struggle tremendously with the concept of suddenly leaving large sums of wealth to heirs ill-equipped to handle the responsibilities of such wealth – the consequence of which results in lives encumbered by the strife of handling all that comes with it. Families must consider the most appropriate method with which to transfer family inheritance to ensure their beneficiaries carry on the way the grantors intended. Beneficiaries should be allowed to prosper with their gained wealth, and we are here to help keep their newly-found responsibilities from setting them back.

Human Capital Preservation

It is every primary breadwinner’s worst nightmare to suddenly leave his family with little to no resources to carry on without that income stream. Careful planning and attention must be given to create a process whereby a family will be provided for in the event of the untimely demise of a family member. It is exceedingly uncomfortable for our culture to talk about loss of life, however the consequence of failing to do so is far worse. Our process of determining the appropriate amount of insurance to maintain the current standard of living is very straightforward and helps clients to quickly grasp the need for doing so.

Philanthropy

Charitable Giving

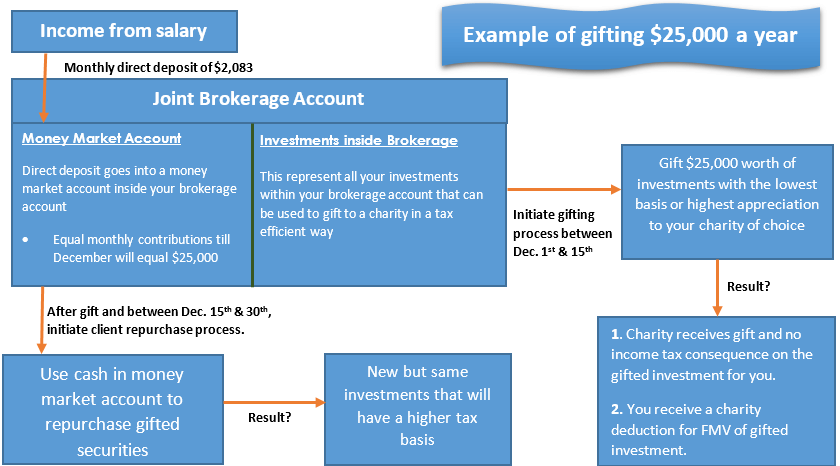

Quite commonly, families will make charitable contributions to their favorite charities. Unfortunately, most charitable contributions are made as cash donations. Although greatly appreciated by charitable organizations, this transaction might not be the most tax advantaged.

Quite commonly, families will make charitable contributions to their favorite charities. Unfortunately, most charitable contributions are made as cash donations. Although greatly appreciated by charitable organizations, this transaction might not be the most tax advantaged.

Instead of contributing cash, a taxpayer is permitted to donate appreciated investments and receive a tax deduction for its fair market value. Not only does the taxpayer avoid gain recognition of the donation, but also receives the fair market value deduction. Furthermore, the investor can use the cash that would have been donated to repurchase the original investment to reset its basis for tax purposes. The graphic to the right provides a simple illustration of a client donating $25,000 per year to charity.

Wealth Administration

Consolidated Client Portal | Account Statements | Miscellaneous Support

Introduction

Clients of AtlasMark gain access to our wealth administrative services – our goal is to provide the infrastructure for continual oversight, safeguarding clients’ financial assets and providing clients with ongoing wealth management and administration.

We provide clients with an online wealth management portal, monthly account statements, day-to-day financial decision support and a variety of other financial services. We want our clients to know that we are always available to help with financial decisions and offer ongoing solutions to their daily needs.

Consolidated Client Portal

Wealth Summary

We provide our clients a consolidated reporting console for all of their investment and financial assets. Using our proprietary reporting platform Wealth Summary, we track and report on all of our clients’ investment assets, even those held away. This system has proven to be a highly effective and invaluable tool for evaluating performance and tracking overall wealth management objectives. Wealth Summary also allows clients to set up a budget, track spending and saving habits and several other financial aspects.

Account Statements

Fidelity Account Statements

Fidelity acts as our clients’ custodian – the institution that holds our clients assets, executes trades and provides administrative support. Our clients are able to log into their Fidelity account at any time to see transaction history, download tax forms and statements, review account balances and much more. Since AtlasMark does not prepare client statements, there is an inherent checks and balances system in place to further safeguard client assets.

Miscellaneous Support

Negotiations

We want to help our clients get the best deal possible for the sale of a business or the purchase of a large ticket item. If a client wants to purchase a car, boat, house or any other major asset, we want our clients to know we are available to help negotiate, perform due diligence and take the emotion out of the equation to simply focus on the numbers.

Business Succession

Selling a business can be extremely complicated – after all it is frequently a client’s largest asset. Tax implications, negotiations, contractual arrangements and reinvestment of sale proceeds are a few of the factors contributing to the overall complexities of the sale. AtlasMark’s team of legal, tax, and business experts are available to guide and support you through the entire process.

Financing Tracker

We frequently help clients to review, negotiate and accept loan terms and interest rates from lending institutions for mortgages and other loans. AtlasMark has the expertise to help clients understand the various loan provisions and key measures for acceptability.